The Hindu : Page 10

Syllabus GS: 03 : Indian Economy

Context :

- The FY25 Union Budget emphasises fiscal stability and sustainable growth, addressing economic imbalances with a focus on agriculture, employment, and MSMEs.

- It boosts funding for housing and production-linked incentives, while maintaining fiscal discipline. The budget also supports fiscal consolidation and prepares India for potential sovereign rating upgrades.

Focus on ‘weaker building blocks’

- The 8.2% GDP growth in FY24, while commendable, was driven by an uneven K-shaped segmentation.

- The premiumisation of consumption, as seen in the robust demand for luxury cars, houses and goods, coincided with stagnant wages, low fast-moving consumer goods sales and (food) inflation continuing to vociferously bite those at the bottom end of the income pyramid.

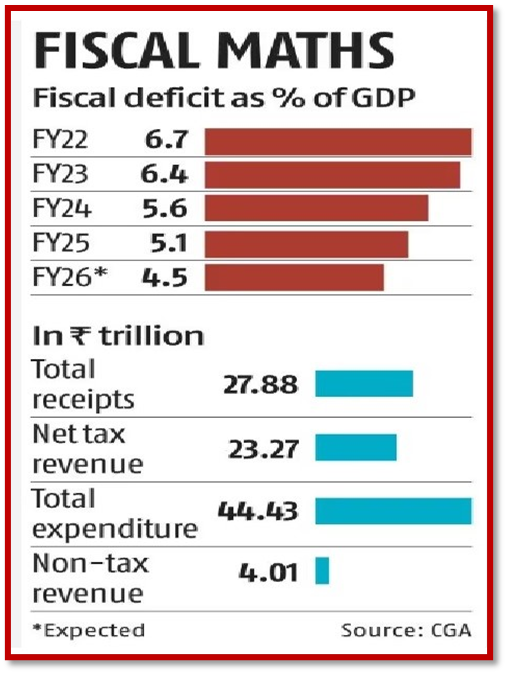

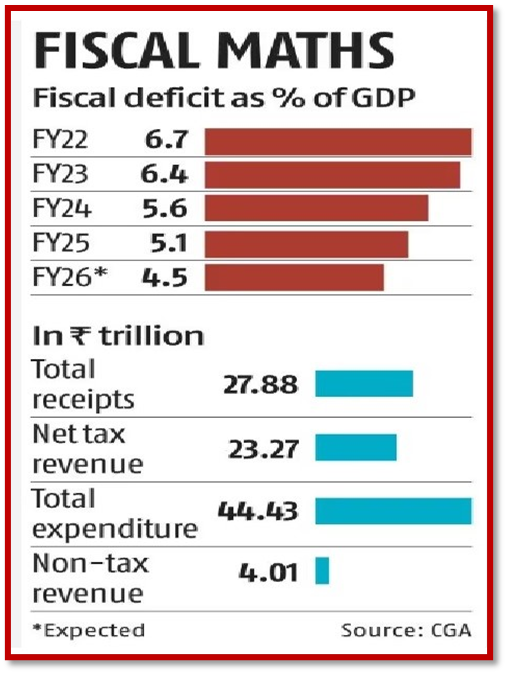

- The fiscal deficit, at 5.6% of GDP in FY24, still high compared to pre-COVID-19 pandemic levels, provided the needed growth impetus via capital spending at a time when the private capex cycle remained much on the sidelines.

- Against this background, the FY25 Budget, through a panoply of measures, has addressed the weaker building blocks, viz. to improve the quality of employment, fortify agriculture and bring in the micro, small and medium enterprises (MSMEs) into a meaningful role play in India’s manufacturing renaissance. This will pave the path to establish a Viksit Bharat by 2047.

- From an agriculture perspective — currently a key priority — promotion of Atmanirbharta in pulses and oilseeds, a focus on agriculture research. large-scale clusters for vegetable production, and Digital Public Infrastructure (DPI) in agriculture for coverage of farmers and their lands, are all likely to support the Annadata (i.e., farmer).

- A thriving agriculture sector will allow the government to deliver on its promise of foodgrains under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), now extended for five years.

On employment generation

- The Budget entailed an energised focus on employment generation, for the youth especially, within the ambit of the formal workforce.

- A new scheme offering incentives to employers as well as employees who join the workforce for the first time, was announced at an outlay of ₹10,000 crore through the Ministry of Labour.

- Other fresh schemes incentivising internships with an outlay of ₹2,000 crore, and for skilling youth in collaboration with State governments and industry were envisaged.

- This somewhat resonates with the tripartite compact (between Centre, States, private sector) that the Economic Survey had recommended on the eve of the FY25 Union Budget to deliver on the rising aspirations of Indian youth.

- Outlay towards housing saw a massive jump in the FY25 Budget.

- For urban Pradhan Mantri Awas Yojana (PMAY), the government allocated 37% more funds in FY25 versus FY24, which though impressive, pales into some degree of insignificance when compared to the 70% jump budgeted for the rural counterpart of the scheme.

- Housing for all remains a key hallmark of the government, which now embarks on its version 2.0.

- The PLI Scheme too got a handsome raise of 75% in the FY25 Budget, driven by higher allocation to the auto sector.

- This was accompanied by tweaks to sectoral custom duties in a bid to support domestic manufacturing and deepen local value addition.

- Financing constraints, typically faced by MSMEs, were addressed via promise to facilitate term loans to MSMEs for purchase of machinery and equipment without collateral.

- To facilitate improved and undisrupted lending, banks will now be allowed to develop in-house credit assessment and a facilitation backed by the government to continue to extend credit to MSMEs even during stress times.

- Most of these measures will dovetail handsomely with the macro focus of pushing a job-led growth in the medium term.

- Commendably, the government has succeeded in maintaining the fiscal discipline whilst extending a wide gamut of measures to stimulate the economy.

Other changes

- Compared to the interim Budget’s fiscal deficit estimate of 5.1% of GDP, the government pruned the FY25 headline deficit target to 4.9%.

- It kept the intended 70 Basis points consolidation over FY24 intact, as in the interim Budget. This allows for a smoother transition to 4.6% fiscal deficit to GDP in FY26.

- The display of intent to continue to consolidate its fiscal position well beyond FY26, preserves the trust that this government has earned from economy watchers in the last few years, despite facing the pressure of new demands by regional partners.

- While the capex target was left unchanged at ₹11.1 trillion, the gains from the Reserve Bank of India’s transfer of a record high dividend of ₹2.1 trillion earlier this year were divided between higher welfare spends and a reduction in fiscal deficit.

Conclusion

- All this will serve India well, at a time when domestic bonds have embarked on a maiden journey of getting included in global bond indices.

- In the face of greater scrutiny of India’s fiscal metrics by international agencies, now more than ever, an adherence to fiscal discipline prepares the groundwork for the possibility of a sovereign rating upgrade in the future.

Mains Practice Question : Evaluate the key measures in the FY25 Union Budget aimed at enhancing economic stability, supporting agriculture, and promoting employment?