The Hindu : Page 08

Syllabus GS: 03 : Indian Economy

- The FY25 Budget underscores urban development by focusing on housing, infrastructure, and city planning.

- It proposes new investments in housing and infrastructure, supports the Smart Cities Mission and digital urban management, and addresses solid waste and street vendor issues.

- Effective implementation and citizen engagement are crucial for success.

Urban Population Growth and Need for Investment

- India’s urban population, approximately 50 crore, represents 36% of the total population, growing at 2% to 2.5% annually.

- The FY25 Budget acknowledges the importance of cities as growth hubs and outlines a strategic vision for their development.

Housing Initiatives

- The Pradhan Mantri Awas Yojana (Urban) has been in effect since 2015, providing 85 lakh housing units for Economically Weaker Sections (EWS) and Middle Income Groups (MIG) with an investment of ₹8 lakh crore.

- The Budget proposes the construction of an additional one crore housing units in urban areas, with a total investment of ₹10 lakh crore.

- Central assistance for this initiative amounts to ₹2.2 lakh crore over the next five years, with ₹30,171 crore allocated for the current year.

- New rental housing for industrial workers will be developed in public-private partnership (PPP) mode with Viability Gap Funding (VGF) support of 20% from the central government and potential matching support from State governments.

Core Infrastructure Investments

- Core infrastructure needs for cities include water supply, sanitation, roads, and sewerage systems.

- The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) provides ₹8,000 crore, with the VGF window available for projects undertaken in PPP mode.

- The Budget allocates ₹11.11 lakh crore for overall capex, including infrastructure, with ₹1.50 lakh crore provided to States as interest-free loans for infrastructure development, which could benefit urban areas.

Smart Cities Mission and New Initiatives

- The Smart Cities Mission budget has decreased from ₹8,000 crore in 2023-24 to ₹2,400 crore in 2024-25.

- However, the new National Urban Digital Mission (NUDM) has been introduced with ₹1,150 crore allocated for digitising property and tax records, and GIS mapping, aiding urban local bodies in better financial management.

City Planning and Transit Development

- The Budget emphasises planned city development with a Finance Commission Grant of ₹25,653 crore and ₹500 crore allocated for incubating new cities.

- Enhanced focus is given to economic and transit planning, encouraging transit-oriented development around transit hubs.

- Funding of ₹1,300 crore is provided for electric bus systems, aiming to make public transport more economical and eco-friendly.

Solid Waste Management (SWM)

- Solid waste management is highlighted as a critical issue. The Budget introduces special measures to develop bankable SWM projects in collaboration with State governments and financial institutions, utilizing the VGF where applicable. Indore, Madhya Pradesh, serves as an example of successful SWM implementation.

Street Vendors and Public Spaces

- The Budget proposes the development of 100 weekly ‘haats’ or street food hubs in select cities to support street vendors, building on the Street Vendors Act, 2014, which regulates street vending and aims to make it a safe and viable option for vendors and consumers.

Challenges and Call to Action

- Despite the Budget’s provisions, there is a call for cities and municipalities, guided by State governments, to demonstrate vision and determination to utilise the resources effectively.

- Citizen participation is essential for the success of urban development strategies.

Conclusion

- The FY25 Budget provides a comprehensive framework for urban development, focusing on housing, infrastructure, city planning, and waste management.

- The success of these initiatives will depend on effective implementation, collaboration with State governments, and active citizen involvement.

Budget and Constitutional Provisions

- According to Article 112 of the Indian Constitution, the Union Budget of a year is referred to as the Annual Financial Statement (AFS).

- It is a statement of the estimated receipts and expenditure of the Government in a financial year (which begins on 01 April of the current year and ends on 31 March of the following year). In addition to it, the Budget contains:

o Estimates of revenue and capital receipts,

o Ways and means to raise the revenue,

o Estimates of expenditure,

o Details of the actual receipts and expenditure of the closing financial year and the reasons for any deficit or surplus in that year, and

o The economic and financial policy of the coming year, i.e., taxation proposals, prospects of revenue, spending programme and introduction of new schemes/projects.

- In Parliament, the Budget goes through six stages:

o Presentation of Budget.

o General discussion.

o Scrutiny by Departmental Committees.

o Voting on Demands for Grants.

o Passing of Appropriation Bill.

o Passing of Finance Bill.

- The Budget Division of the Department of Economic Affairs in the Finance Ministry is the nodal body responsible for preparing the Budget.

Changes Introduced in 2017

- Advancement of Budget presentation to February 1 (earlier presented on the last working day of February),

- Merger of Railway Budget with the General Budget, and

- Doing away with plan and non-plan expenditure.

Key Words

- Receipts: It indicates the money received by the government. This includes:

o the money earned by the government

o the money it receives in the form of borrowings or repayment of loans by states.

- Plan Expenditure: All expenditures done in the name of planning (i.e. Five Year Plans) were called plan expenditures. For example expenditure on electricity generation, irrigation and rural developments, construction of roads, bridges, canals, etc.

- Non-plan Expenditure: All expenditures other than plan expenditure were known as non-plan expenditure. For example interest payments, pensions, statutory transfers to States and Union Territories governments, etc.

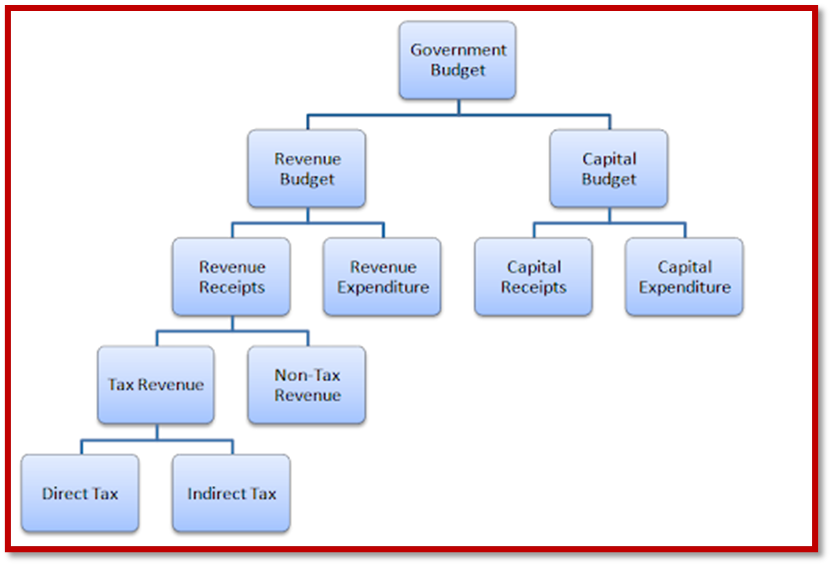

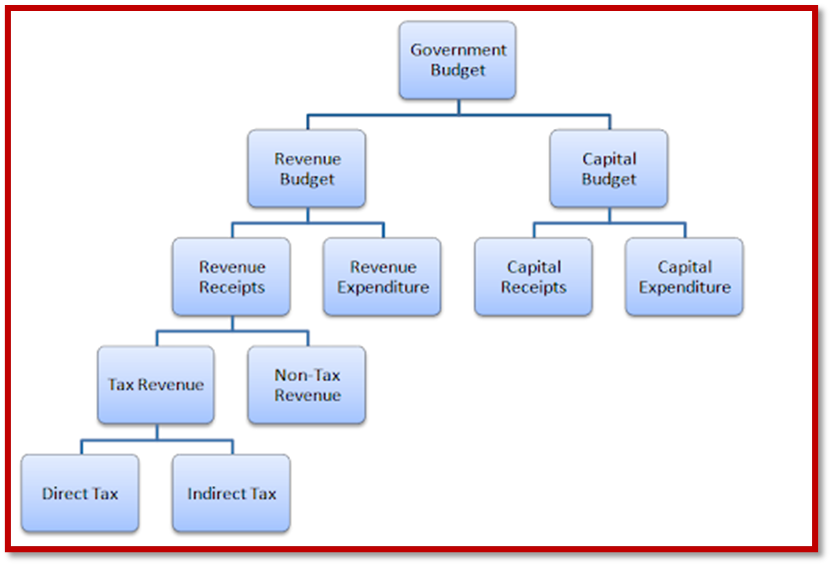

Components of Government Budget

- Revenue Budget– It consists of the Revenue Expenditure and Revenue Receipts.

o Revenue Receipts are receipts which do not have a direct impact on the assets and liabilities of the government. It consists of the money earned by the government through tax (such as excise duty, income tax) and non-tax sources (such as dividend income, profits, interest receipts).

o Revenue Expenditure is the expenditure by the government which does not impact its assets or liabilities. For example, this includes salaries, interest payments, pension, and administrative expenses.

- Capital Budget– It includes the Capital Receipts and Capital Expenditure.

o Capital Receipts indicate the receipts which lead to a decrease in assets or an increase in liabilities of the government. It consists of: (i) the money earned by selling assets (or disinvestment) such as shares of public enterprises, and (ii) the money received in the form of borrowings or repayment of loans by states.

o Capital expenditure is used to create assets or to reduce liabilities. It consists of: (i) the long-term investments by the government on creating assets such as roads and hospitals, and (ii) the money given by the government in the form of loans to states or repayment of its borrowings.

Other Types of Budgets

- Zero Based Budgeting: Zero-based budgeting is a method of budgeting in which all expenses are evaluated each time a Budget is made and expenses must be justified for each new period.

o Zero budgeting starts from the zero base and every function of the government is analysed for its needs and cost. Budget is then made based on the needs

- Outcome Budget: Outcome Budget analyses the progress of each ministry and department and what the respected ministry has done with its Budget outlay. It measures the development outcomes of all government programs. It was first introduced in the year 2005.

- Gender Budgeting: The gender-budgeting is defined as “gender-based assessment of Budgets, incorporating a gender perspective at all levels of the budgetary process and restructuring revenues and expenditures in order to promote gender equality”. It is actually budgeting for gender equity.

o Through Gender Budget, the Government declares an amount to be spent over the development, Welfare, Empowerment schemes and programmes for Females.

Balanced, Surplus and Deficit Budget

- Balanced Budget – A government Budget is assumed to be balanced if the expected expenditure is equal to the anticipated receipts for a fiscal year.

- Surplus Budget – A Budget is said to be surplus when the expected revenues surpass the estimated expenditure for a particular business year. Here, the Budget becomes surplus, when taxes imposed, are higher than the expenses.

- Deficit Budget- A Budget is in deficit if the expenditure surpasses the revenue for a designated year.