Context

- The Finance Commission revisits the horizontal distribution of Union tax revenue every five years, prioritising intragenerational equity, which can lead to intergenerational inequity.

- High-income States finance more of their expenditure with their own tax revenue but receive fewer Union transfers, whereas low-income States rely heavily on Union financial transfers.

Introduction:

- The distribution of Union tax revenue to States is a key topic in both political and economic discussions.

- The Finance Commission (FC) revisits the horizontal distribution formula every five years, prioritising equity over efficiency.

- Equity in this context refers to intragenerational equity, aiming to redistribute tax revenue among States.

- This approach can lead to intergenerational inequity within States.

Intergenerational Fiscal Equity

- Intergenerational equity ensures equal opportunities and outcomes for all generations.

- It implies that current generations should not burden future generations with debt.

- Governments can raise revenue through taxes or borrowing; borrowing to finance current expenditures imposes future tax burdens, leading to intergenerational inequity.

- The Ricardian Equivalence Theory suggests that households save more when the government borrows, but this does not hold true in India’s federal context.

Horizontal Distribution Formula and Intragenerational Equity

- High-income States like Tamil Nadu, Kerala, Karnataka, Maharashtra, Gujarat, and Haryana raise significant tax revenue and finance their expenditures, whereas low-income States like Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan, Odisha, and Jharkhand rely more on Union transfers.

- During the 14th Financial Commission period (2015-2020), high-income States financed 59.3% of their revenue expenditure through their own tax revenue, compared to 35.9% in low-income States.

- Low-income States received 57.7% of their revenue expenditure from Union transfers, while high-income States received only 27.6%.

Federal Finance Aspects

- Low-income States finance less of their expenditure through their own tax revenue and rely heavily on Union transfers.

- High-income States finance more of their expenditure through their own tax revenue but receive fewer Union transfers.

- High-income States incur higher deficits due to lower Union transfers, while low-income States have lower deficits.

Public Expectations and Fiscal Behavior

- Citizens expect public services to match the taxes they pay, whether through State or Union government services.

- Discrepancies in fiscal behaviour can burden high-income States with higher tax payments for both present and future generations.

- Balancing intragenerational and intergenerational equity is crucial, requiring a balance of equity and efficiency in tax devolution.

Addressing Conflicting Equities

- The Financial Commission typically uses indicators like per capita income, population, and area in the distribution formula, reflecting demand for public services and available public revenue.

- These equity indicators carry more weight than efficiency indicators like tax effort and fiscal discipline.

- Efficiency indicators, based on State budgets, should be given more weight to influence fiscal behaviour positively.

Fiscal Responsibility and Incentivizing Efficiency

- States have Fiscal Responsibility Acts that limit deficits and public debt.

- Reduced Union transfers can compel some States to breach these limits.

- The Financial Commission should assign more weight to fiscal indicators, incentivizing tax effort and expenditure efficiency through larger Union transfers.

- This approach would ensure intergenerational fiscal equity and sustainable debt management by States.

Conclusion: Balancing Equity and Efficiency

- The Financial Commission’s role is to balance equity and efficiency in the distribution formula for tax devolution.

- This balance should address conflicting equity issues and promote fiscal discipline and sustainability.

- Proper implementation of fiscal indicators in the distribution formula can positively influence States’ fiscal behaviour, ensuring both intragenerational and intergenerational equity.

Finance Commission of India

- Article 280 of the Constitution of India provides for a Finance Commission, a quasi-judicial body that recommends principles by which fiscal horizontal and vertical balance can be maintained in the India’s Fiscal Federal Structure.

- Article 270 makes provision for sharing of a share of central taxes with the states. Article 275 provides for statutory grants in Aid and Article 282 provides for discretionary grants for the states. In order to formulate fair principles based on which these grants can be provided to the state, role of finance commission becomes vital in the Indian polity.

Why is there a need for centre to share taxes with the States?

Need for Vertical balance in federalism:

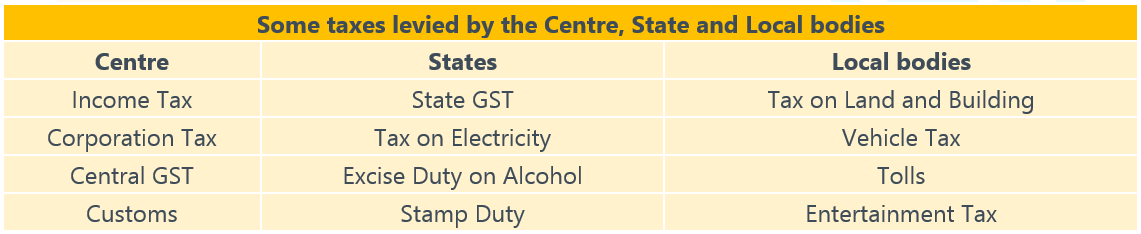

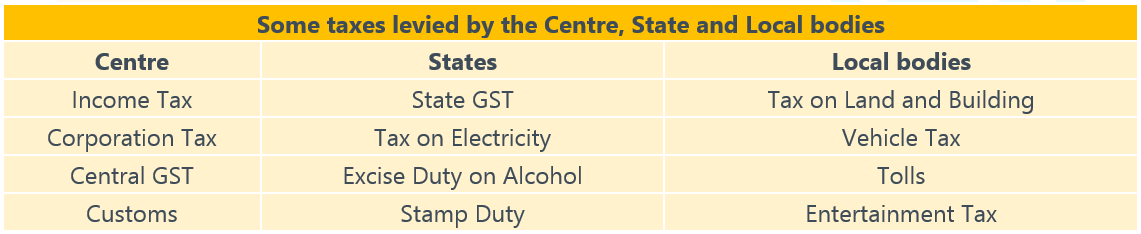

- In the Federal political structure of the Indian Constitution, there is a tendency in favour of the Centre. In fiscal matters, the Centre is much stronger than the states as the revenue-generating taxes, such as Income tax, corporate tax, and half of GST go to the Union.

- Thus, the constitution makers felt a need to make a constitutional provision to mandate the Union to share a portion of its tax revenue with the states under Article 270.

- In this context, the Finance Commission has been created under article 280. The Finance Commission devises a formula to distribute the net tax proceeds between the Centre and states collectively; that is called vertical balance.

Need for Horizontal balance in federalism:

- The Finance Commission also tells how the taxes are to be distributed between different states to maintain the horizontal balance.

- Due to vast regional disparities (e.g. Himalayan States), some states are not able to raise adequate resources as compared to other better-positioned states. To maintain equity, the Finance Commission recommends special funds that can be shared with comparatively disadvantaged states from the Centre’s pool of taxes.

Composition of Finance Commission in India:

- Article 280 mentions that a Finance commission should be established at every five year or earlier by the President through an order.

- Appointment and Removal: Since, the President can appoint the Finance commission at any time before five year, its appointment and removal is at the discretion of the President (i.e. the government).

- The Finance Commission comprises the Chairman and four other members.

- The tenure and the salary are decided by the order of the President.

- The government generally appoints the Finance commission and provides it with a term of reference document, to serve as guiding principles in order to make its recommendations. The commission then studies the fiscal balance of the country and submits its recommendations via a report, which is then laid before the Parliament.

Functions of the Finance Commission

- The constitution mandates the Finance Commission to make the following recommendations to the President of India:

1. The division of the net proceeds of taxes to be shared between the states and the Centre and its allocation between the states.

2. The principles under which the grants-in-aid to the states should be given by the Centre (i.e. out of the Consolidated fund of India).

3. Measures to increase the consolidated fund of a state to supplement the panchayats and the municipalities’ resources in the state based on the recommendations issued by the State Finance Commission (SFC).

4. Any other issue that the President refers to in the interest of sound finance.

Challenges for Finance Commission

- Issue with the Appointment: The selection of the members of the Finance Commission by the Centre has been criticised by the States as against the principle of federalism.

- Little Consultation with states: The terms of reference are generally framed without the consultation of the states. E.g.- 14th FC had used the 1971 Census formula for the horizontal distribution of taxes among states. However, the 15th FC was ordered to use the 2011 Census data, to which the Southern States objected.

Operational Issues:

- Quality of data – The Finance Commission depends on the data provided by the Government to frame its recommendations. Many times, these data are outdated, inconsistent, and incomplete, causing serious quality issues.

- Competing Demands – It is a challenge to comprehensively balance the interests and adjust the demands of all three tiers of Government.

Issues with the Implementation:

- No control over implementation – The Finance Commission has no direct control over how its recommendations are executed or monitored. They also face problems such as non-compliance, misuse or deviation of funds.

- Non-Acceptance of Recommendations – The Finance Commission is an advisory body. The Central Government and the state government may choose not to accept the important recommendations of the Commission.

- Poor Coordination – Lack of coordination or disagreements between the Union and the States can influence the implementation of reforms.

- Grants based on Conditions – Some grants will be provided based on the conditions fulfilled by the states. To fulfil those conditions and receive grants, the state government may end up spending more reckless money or less money than adequately required, creating obstacles in the implementation of policies/schemes.

- Increasing Central Government’s Debt – Mounting debt in the backdrop of global recession causes serious concern as to the acceptance of the Commission’s recommendation for devolution of taxes to the States.

- Increasing indivisible pool of taxes – There is a growing concern among States as the Central Government is increasing Cess and Surcharges, which is not shared with the States, thereby impacting their revenues.

- GST Council Functioning – The decisions taken by the GST Council can impact the revenue projections and computations made by the Finance Commission which in turn can affect the financial resources available for sharing to States.

- Insufficiency of Funds – There is a possibility that the funds allocated for specific reforms may not be sufficient, resulting in poor implementation since financial constraints can limit the availability of resources.

- The Chairman of the Fourth Finance Commission, Dr. P.V. Rajamannar, highlighted how the Finance Commission and the former Planning Commission had similar but overlapping functions and responsibilities.

Terms of Reference (ToR) for the Sixteenth Finance Commission (XVIFC):

- The Terms of Reference (ToR) for the Sixteenth Finance Commission (XVIFC) outline its scope and responsibilities.

- t includes distributing net tax proceeds between the Union and States and allocating shares among States under Chapter I, Part XII of the Constitution.

- The XVIFC determines principles for grants-in-aid from the Consolidated Fund of India to States and sums under Article 275 for specified purposes.

- It also suggests measures to enhance State Consolidated Funds to support Panchayats and Municipalities based on State Finance Commission recommendations.

- Additionally, the commission reviews financing arrangements for Disaster Management initiatives, making recommendations under the Disaster Management Act, 2005.

- The XVIFC’s report is expected by October 31, 2025, covering a five-year period from April 1, 2026.