The Hindu : Page 01

Syllabus : GS 3 : Indian Economy

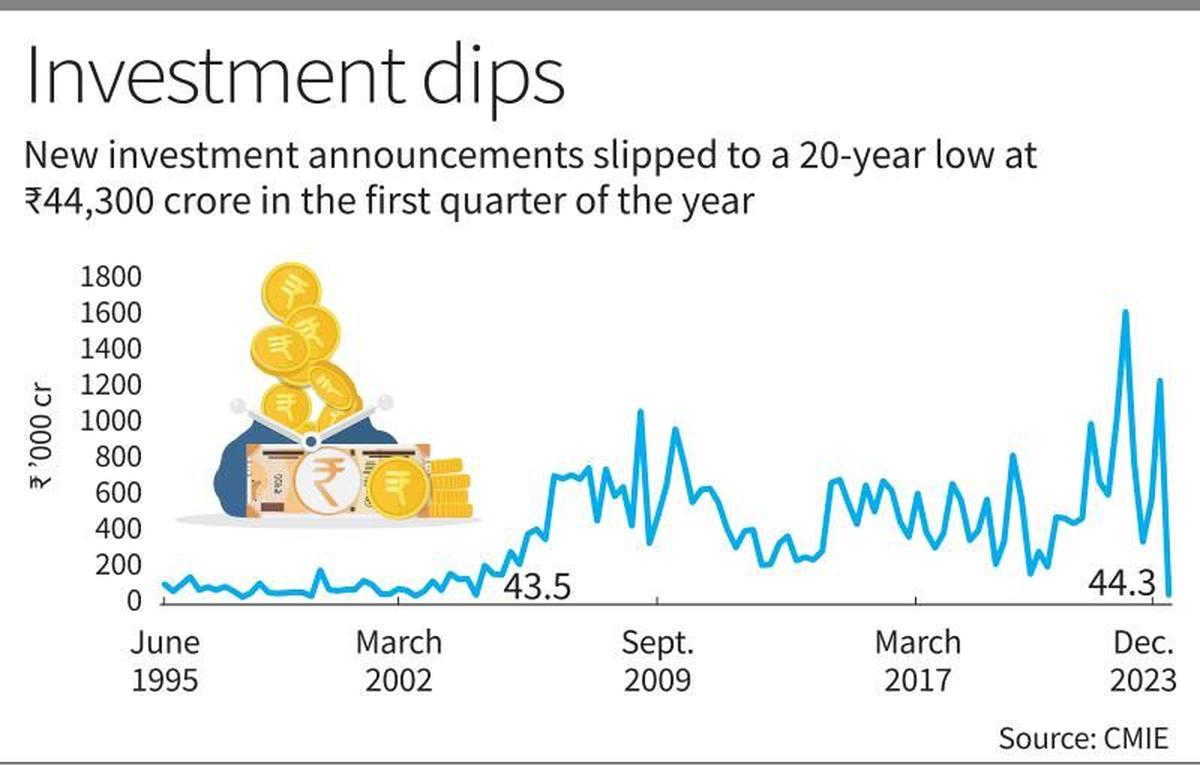

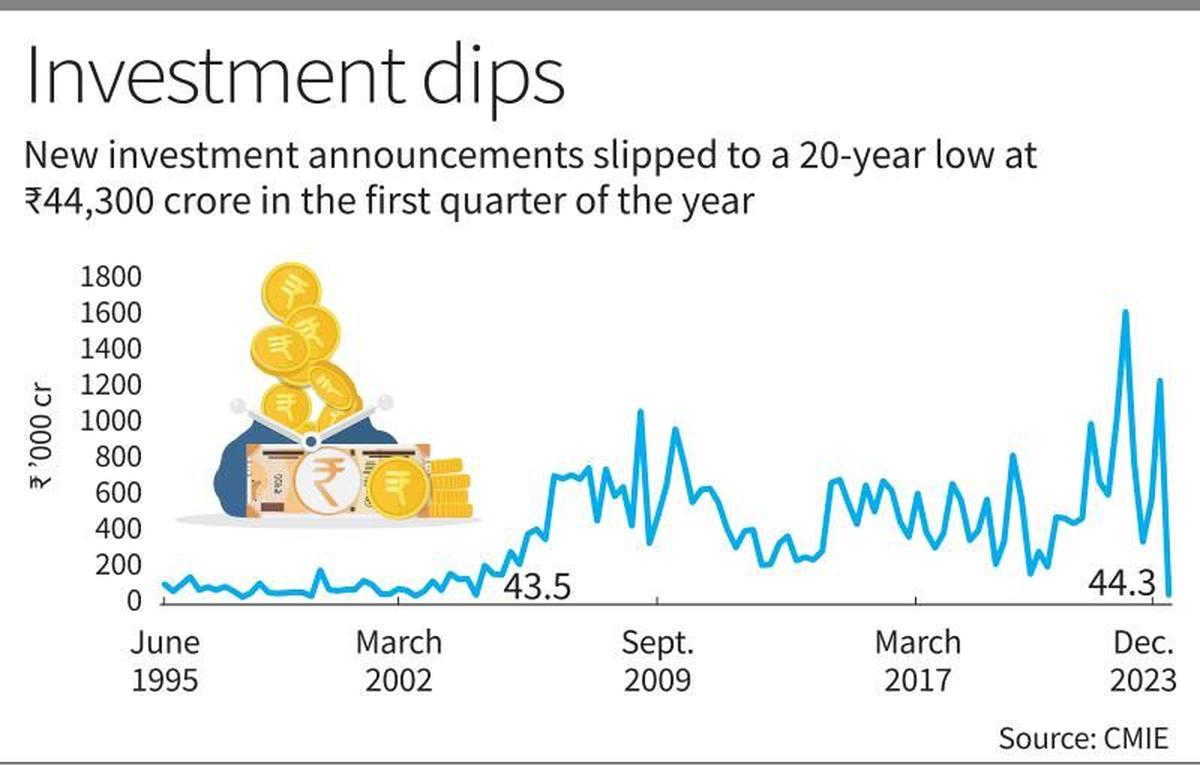

India’s private capital expenditure reached a 20-year low in the April-to-June quarter, with just ₹44,300 crore in new investments.

- Last year, investment announcements totaled ₹27.1 lakh crore, the second highest in a decade.

Importance of private investment for economy:

- Economic Growth: Private investment fuels economic growth by funding new ventures, expanding existing businesses, and fostering innovation.

- Employment Generation: Investments by private entities create job opportunities, reducing unemployment rates and improving living standards.

- Infrastructure Development: Private capital often finances infrastructure projects such as roads, bridges, and telecommunications, enhancing overall economic efficiency.

- Technological Advancement: Private sector investments drive technological innovation and adoption, increasing productivity and global competitiveness.

- Foreign Direct Investment (FDI): A robust private investment climate attracts FDI, bringing in capital, expertise, and technology from abroad.

- Tax Revenue: Profitable private enterprises contribute significantly to government revenues through taxes, aiding public expenditure and development.

- Market Efficiency: Private investments enhance market efficiency by introducing competition, improving product quality, and lowering prices for consumers.

- Risk Diversification: Diversified private investments reduce economic reliance on specific sectors, increasing economic resilience against shocks.

- Sustainable Development: Private sector participation in sustainable projects promotes environmental conservation and long-term economic sustainability.