The Hindu : Page 03

Syllabus : GS 3 : Indian Economy

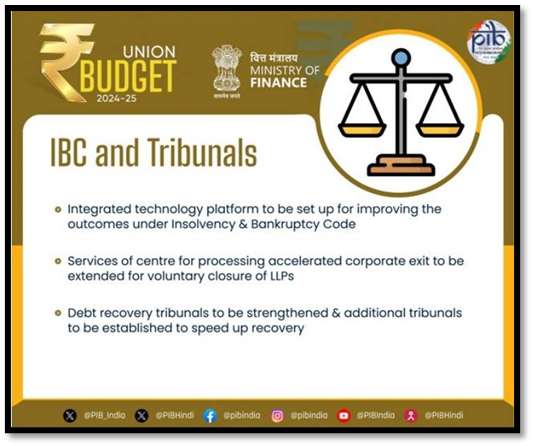

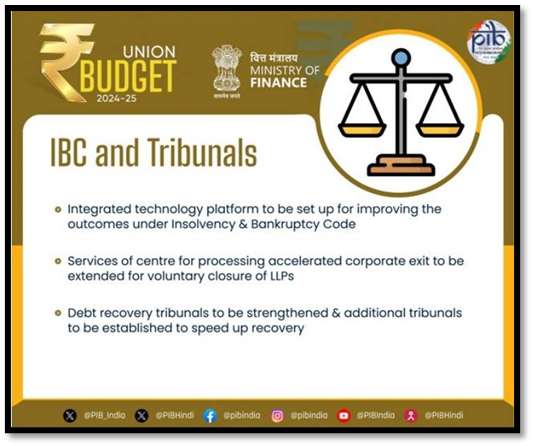

Finance Minister Nirmala Sitharaman proposed an integrated technology platform and additional National Company Law Tribunals (NCLTs) to improve outcomes under the Insolvency & Bankruptcy Code (IBC).

- These measures aim to enhance transparency, consistency, and efficiency in resolution cases, benefiting creditors and expediting recovery processes for the banking sector.

- Finance Minister Nirmala Sitharaman proposed an integrated technology platform to improve outcomes under the Insolvency & Bankruptcy Code (IBC) for transparency, consistency, timely settlement, and better oversight of resolution cases.

- The government will set up additional National Company Law Tribunals (NCLTs) to expedite case resolutions under the IBC.

The IBC has resolved 1,000 companies, resulting in ₹3.3 lakh crore direct recovery to creditors and disposed of cases worth ₹10 lakh crore before admission.

The IBC has resolved 1,000 companies, resulting in ₹3.3 lakh crore direct recovery to creditors and disposed of cases worth ₹10 lakh crore before admission.- Additional tribunals will be dedicated to resolving cases exclusively under the Companies Act.

- M. V. Rao, Chairman of the Indian Banks’ Association (IBA) and CEO of Central Bank of India, stated that these measures will benefit the banking sector by enhancing the speed of recovery processes.

- The Centre for Processing Accelerated Corporate Exit (C-PACE) will extend its services for the voluntary closure of LLPs.

- Strengthening of National Company Law Tribunals and establishing more debt recovery tribunals are seen as positive steps for the banking sector.

- Anoop Rawat, Partner at Shardul Amarchand Mangaldas & Co., highlighted that the integration of the IBC ecosystem through a tech platform will increase the utility and efficiency of the Corporate Insolvency Resolution (CIR) process.

- Improvements in the legislative framework and increased tribunal strength are expected to enhance process efficiency.

- Technological integration will help identify sources of delay and implement corrective measures to improve efficiency.

UPSC Prelims PYQ : 2017

Ques : Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news?

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented by the Government.

Ans: (b)