The Hindu : Page 06

Syllabus : GS: 1,2 &3 : Indian Society ,Governance & Economics

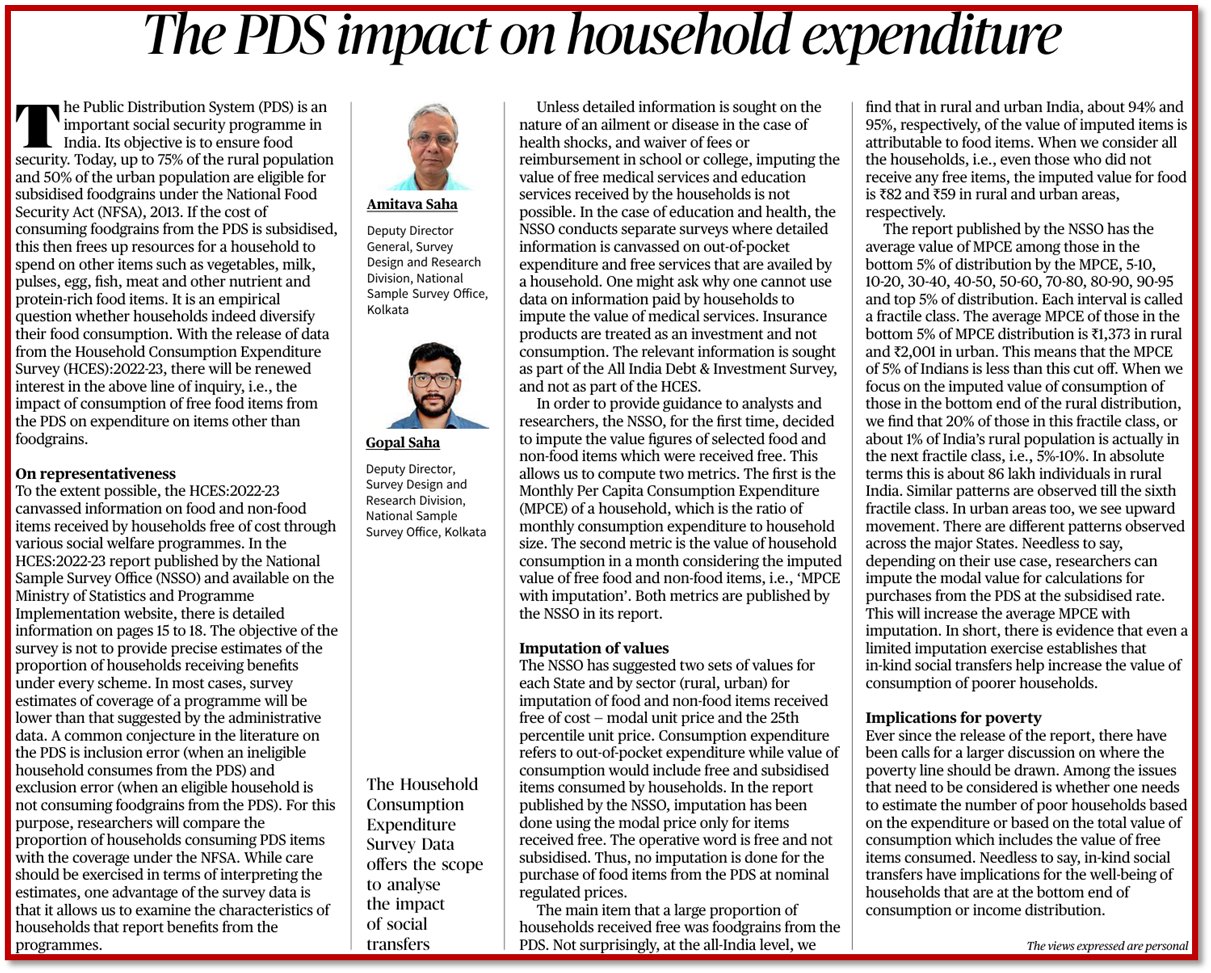

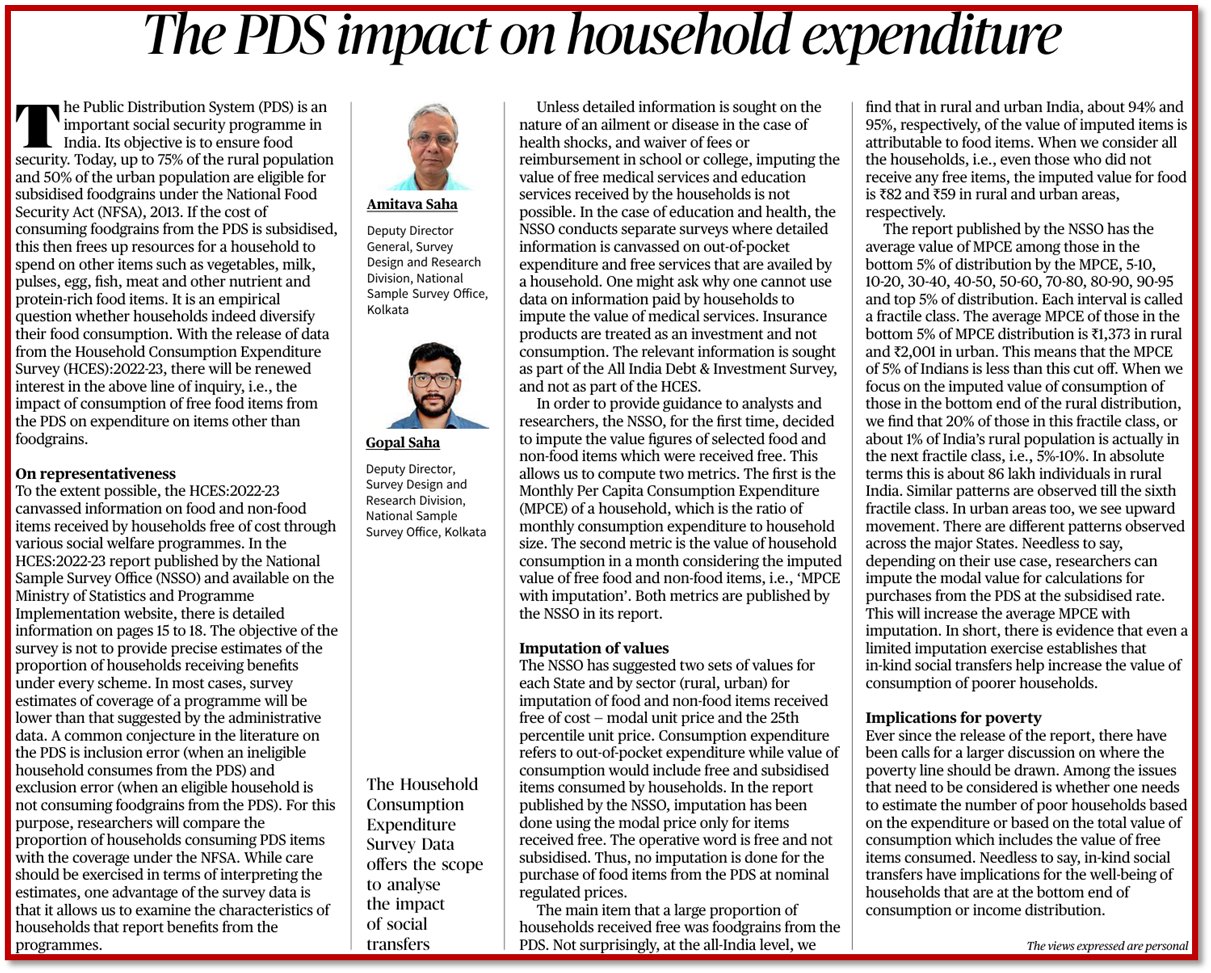

Context

- The Household Consumption Expenditure Survey (HCES): 2022-23 examines the impact of India’s Public Distribution System (PDS) on household spending patterns.

- It includes imputed values of free items received, providing insights into consumption diversification and poverty estimation implications based on comprehensive data.

Introduction to Public Distribution System (PDS) and National Food Security Act (NFSA)

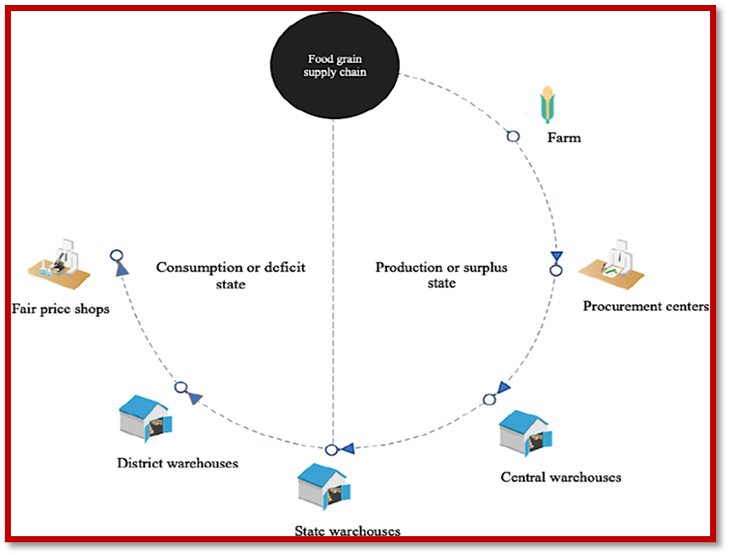

- The Public Distribution System (PDS) aims to ensure food security by providing subsidized foodgrains to economically vulnerable sections of society. Under the National Food Security Act (NFSA), 2013, up to 75% of the rural population and 50% of the urban population are eligible for subsidized foodgrains.

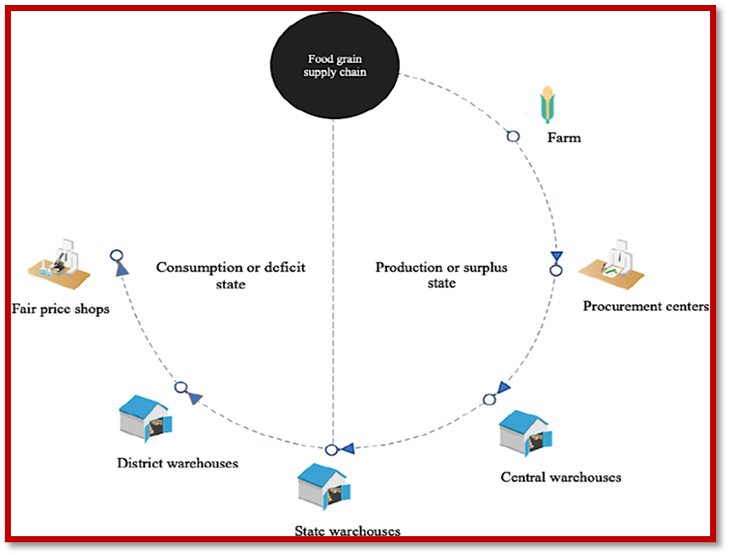

- Foodgrains procured by the Food Corporation of India (FCI) are distributed through a network of Fair Price Shops (FPS).

Impact of PDS on Household Expenditure

- Empirical Inquiry: The HCES: 2022-23 provides data on how households allocate resources when receiving free food items from the PDS.

- Diversification of Consumption: It investigates whether households indeed diversify spending on items beyond food grains, such as vegetables, pulses, and proteins.

Its structural mandate:

- Procurement and Distribution: The PDS operates through the procurement of foodgrains by the Food Corporation of India (FCI) from farmers at Minimum Support Prices (MSP). These foodgrains are then allocated to states and union territories based on their requirements and distributed to Fair Price Shops (FPS), which deliver subsidized foodgrains to eligible beneficiaries.

- Identification and Subsidy: Beneficiaries are identified based on the Socio-Economic and Caste Census (SECC) data, classifying households into Priority Households and Antyodaya Anna Yojana (AAY) households. Under the National Food Security Act (NFSA), 2013, eligible households receive rice at ₹3 per kg, wheat at ₹2 per kg, and coarse grains at ₹1 per kg. The system aims to ensure that food security is maintained for the economically vulnerable sections of society.

Key Findings from HCES:2022-23

- The Household Consumption Expenditure Survey (HCES) 2022-23 provides insights into the coverage of social welfare programs, including the Public Distribution System (PDS).

- The survey highlights discrepancies between administrative data and survey estimates due to inclusion and exclusion errors, offering detailed characteristics of households benefiting from these programs.

Imputation of values for food and non-food items

- Note: Imputation of values for food and non-food items refers to the process of assigning a monetary value to items received by households for free or at a subsidised rate through social welfare programs like the Public Distribution System (PDS) in India.

- Purpose: Imputation is done to estimate the total consumption expenditure of households more accurately. It accounts for the fact that households receive goods (such as foodgrains from PDS) without directly paying for them, thus impacting their overall consumption.

- Details on Imputation Methodology: The National Sample Survey Office (NSSO) and other agencies use statistical methods to assign a value to these items. This involves determining the modal (most common) or percentile prices of the items received, which may vary by state and rural/urban classification.

- Types of Items Imputed: Imputation covers both food and non-food items. In the context of the PDS, it primarily includes foodgrains but can extend to other essential commodities provided through government schemes.

- Data Sources: Data for imputation can come from surveys like the HCES, where households report receiving these items. NSSO surveys typically provide detailed guidelines on how imputation values are derived and applied in their reports.

- Impact on Analysis: Imputing values allows analysts to compute metrics like the Monthly Per Capita Consumption Expenditure (MPCE) accurately, reflecting the true economic status and welfare impact of households.

Implications for Poverty Estimation

- Economic Relief for Poorer Households: By providing foodgrains at highly subsidized rates, the PDS reduces the financial burden on poorer households, allowing them to allocate their limited resources to other essential needs.

- Enhanced Measurement of Poverty: Imputing the value of free or subsidised items received through programs like the PDS allows for a more comprehensive assessment of household consumption. Including these imputed values in poverty measurements provides a more accurate reflection of the economic well-being of households.

- Policy Insights and Targeting: Understanding how imputed values impact poverty metrics helps policymakers in targeting social welfare programs more effectively.

- Diversification of Diet: Access to subsidized foodgrains from the PDS allows households to free up resources, potentially enabling them to purchase a more diverse range of nutrient and protein-rich foods such as vegetables, milk, pulses, eggs, fish, and meat.

Conclusion and Policy Considerations

- The HCES: 2022-23 underscores the critical role of PDS in improving food security and potentially enhancing overall household welfare.

- It calls for nuanced poverty estimation discussions based on comprehensive consumption data, reflecting the impact of social welfare programs.

Poverty

Introduction

- According to World Bank, Poverty is pronounced deprivation in well-being, and comprises many dimensions. It includes low incomes and the inability to acquire the basic goods and services necessary for survival with dignity. Poverty also encompasses low levels of health and education, poor access to clean water and sanitation, inadequate physical security, lack of voice, and insufficient capacity and opportunity to better one's life.

- In India, 21.9% of the population lives below the national poverty line in 2011.

Types of Poverty: There are two main classifications of poverty:

- Absolute Poverty: A condition where household income is below a necessary level to maintain basic living standards (food, shelter, housing). This condition makes it possible to compare between different countries and also over time. It was first introduced in 1990, the “dollar a day” poverty line measured absolute poverty by the standards of the world's poorest countries. In October 2015, the World Bank reset it to $1.90 a day.

- Relative Poverty: It is defined from the social perspective that is living standard compared to the economic standards of population living in surroundings. Hence it is a measure of income inequality.

Poverty Estimation in India

- Poverty estimation in India is carried out by NITI Aayog’s task force through the calculation of poverty line based on the data captured by the National Sample Survey Office under the Ministry of Statistics and Programme Implementation (MOSPI).

- Poverty line estimation in India is based on the consumption expenditure and not on the income levels.

- Poverty is measured based on consumer expenditure surveys of the National Sample Survey Organisation. A poor household is defined as one with an expenditure level below a specific poverty line.

- The incidence of poverty is measured by the poverty ratio, which is the ratio of the number of poor to the total population expressed as a percentage. It is also known as head-count ratio.

- Alagh Committee (1979) determined a poverty line based on a minimum daily requirement of 2400 and 2100 calories for an adult in Rural and Urban area respectively.

- Subsequently different committees; Lakdawala Committee (1993), Tendulkar Committee (2009), Rangarajan committee (2012) did the poverty estimation.

- As per the Rangarajan committee report (2014), the poverty line is estimated as Monthly Per Capita Expenditure of Rs 1407 in urban areas and R. 972 in rural areas.

Causes of Poverty in India

- Population Explosion

- Low Agricultural Productivity

- Inefficient Resource utilisation

- Low Rate of Economic Development

- Price Rise

- Unemployment

- Lack of Capital and Entrepreneurship

- Social Factors

- Colonial Exploitation

- Climatic Factors

Poverty Alleviation Programs in India

- Integrated Rural Development Programme (IRDP)

- Jawahar Rozgar Yojana/Jawahar Gram Samridhi Yojana

- Rural Housing – Indira Awaas Yojana

- Food for Work Programme

- National Old Age Pension Scheme (NOAPS)

- Annapurna Scheme

- Sampoorna Gramin Rozgar Yojana (SGRY)

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) 2005

- National Rural Livelihood Mission: Aajeevika (2011)

- National Urban Livelihood Mission

- Pradhan Mantri Kaushal Vikas Yojana

- Pradhan Mantri Jan Dhan Yojana

- Pradhan Mantri Gareeb Kalyan Yojana